Stock Market Indicators Every Investor Needs to Use for Better Profit

The investment game isn’t going to be stable without stock market indicators. They’re your tools to gain profit in the stock market. So, what are they? Basically, these indicators are statistical data that show market trends and movements. They’re important because they help investors determine the right time to buy or sell stocks. But how do these indicators work? More importantly, what are the best indicators to use? Let’s find out.

Moving Averages

Moving Averages are key indicators that help investors analyze price trends over a specific period. By crunching numbers of the average price of a certain stock over time, Moving Averages smooth out fluctuations and reveal underlying patterns. They come in various forms, such as SMA and EMA. Each offers unique insights into market movements. Short-term or simple Moving Averages react quickly to price changes, making them ideal for short-term traders looking to capitalize on immediate trends. Conversely, exponential or long-term Moving Averages provide a broader perspective on overall market direction and are favored by long-term investors seeking stability amidst volatility.

Moving Averages are key indicators that help investors analyze price trends over a specific period. By crunching numbers of the average price of a certain stock over time, Moving Averages smooth out fluctuations and reveal underlying patterns. They come in various forms, such as SMA and EMA. Each offers unique insights into market movements. Short-term or simple Moving Averages react quickly to price changes, making them ideal for short-term traders looking to capitalize on immediate trends. Conversely, exponential or long-term Moving Averages provide a broader perspective on overall market direction and are favored by long-term investors seeking stability amidst volatility.

Relative Strength Index (RSI)

This indicator, on the flip side, measures the speed and change of price movements. This will be a good ace for traders to identify overbought or oversold conditions in a particular asset. In other words, by using RSI, investors can make the best stock decisions when it comes to buying or selling. In this alpha picks review, you’ll learn how RSI is very important in choosing the best stock. A high RSI value suggests that an asset may often be overvalued and due for a potential price correction, while a low RSI value indicates it might be undervalued. Traders often use RSI in conjunction with other technical indicators to confirm signals and minimize risks. Understanding how to interpret RSI readings can give investors an edge in predicting market reversals and maximizing profits.

Bollinger Bands

These bands consist of three lines: a simple moving average (SMA) we’ve talked about in the middle and two pretty standard deviation lines above and below it. The upper and lower bands basically expand and contract based on market volatility, providing traders with insights into whether a stock is considered overbought or oversold. When prices reach the upper band, it shows that the stock is overvalued, while touching the lower band could suggest undervaluation. It’s essential to combine this indicator with other tools for comprehensive analysis before making any investment moves.

MACD (Moving Average Convergence Divergence)

Moving Average Convergence Divergence is a pretty common technical indicator used by traders to pinpoint certain trends and potential buy or sell clear signals. It consists of two moving averages that help determine the momentum of a stock’s price movement. The MACD indicator plots the difference between a short-term exponential moving average (EMA) and a longer-term EMA on a chart. Traders pay attention to the convergence and divergence of these two lines as they can signal upcoming trend changes.

Moving Average Convergence Divergence is a pretty common technical indicator used by traders to pinpoint certain trends and potential buy or sell clear signals. It consists of two moving averages that help determine the momentum of a stock’s price movement. The MACD indicator plots the difference between a short-term exponential moving average (EMA) and a longer-term EMA on a chart. Traders pay attention to the convergence and divergence of these two lines as they can signal upcoming trend changes.

Basically, when the MACD line crosses above the signal line, it’s considered a bullish signal, indicating potential buying opportunities. While these indicators are essential tools for investors, there are numerous other indicators available that offer unique insights into market behavior. Some additional indicators worth exploring include stochastic oscillators, Fibonacci retracement levels, volume analysis, and trendlines. By incorporating a variety of technical indicators into their trading strategy, investors can develop a well-rounded approach to analyzing stocks’ performance accurately.

Your credit score is like a financial report card that lenders use to determine your creditworthiness. It is crucial in determining whether you can secure a loan, get approved for a mortgage, or even qualify for low-interest rates on credit cards. Simply put, it indicates how responsible you are with managing your finances. Paying bills on time is one of the most significant factors impacting your credit score. Late payments can cause severe damage and stay on your credit report for years, making it harder for you to access favorable financial opportunities in the future.

Your credit score is like a financial report card that lenders use to determine your creditworthiness. It is crucial in determining whether you can secure a loan, get approved for a mortgage, or even qualify for low-interest rates on credit cards. Simply put, it indicates how responsible you are with managing your finances. Paying bills on time is one of the most significant factors impacting your credit score. Late payments can cause severe damage and stay on your credit report for years, making it harder for you to access favorable financial opportunities in the future.

Financial organization is key to managing your

Financial organization is key to managing your

Not having an IRA can be a costly mistake that many people make every day. Without an IRA, you’re missing out on a powerful tool for retirement savings and tax advantages. It’s like going into battle without any armor or weapons! Having an IRA allows you to contribute money each year towards your retirement goals. Both a traditional IRA and a Roth IRA offer unique benefits depending on your financial situation and future plans. By not having an IRA, you’re essentially leaving money on the table.

Not having an IRA can be a costly mistake that many people make every day. Without an IRA, you’re missing out on a powerful tool for retirement savings and tax advantages. It’s like going into battle without any armor or weapons! Having an IRA allows you to contribute money each year towards your retirement goals. Both a traditional IRA and a Roth IRA offer unique benefits depending on your financial situation and future plans. By not having an IRA, you’re essentially leaving money on the table. It’s pretty common to see many people focus on saving and investing in their individual retirement accounts (IRAs). While this is certainly an important aspect of building a secure financial future, there are some common mistakes that individuals often make when it comes to their IRAs. One such mistake is not having an accurate beneficiary designated. Having a beneficiary designation is crucial because it ensures that your hard-earned money goes to the person or people you want it to go to after you pass away. Without a designated beneficiary, your IRA assets may end up in probate or be spread out, referring to state laws, which may not align with your wishes. Getting professional advice or consulting with experienced financial advisors could be invaluable in avoiding costly missteps along the way. So take charge of your financial future and start making smart choices with your IRA now.

It’s pretty common to see many people focus on saving and investing in their individual retirement accounts (IRAs). While this is certainly an important aspect of building a secure financial future, there are some common mistakes that individuals often make when it comes to their IRAs. One such mistake is not having an accurate beneficiary designated. Having a beneficiary designation is crucial because it ensures that your hard-earned money goes to the person or people you want it to go to after you pass away. Without a designated beneficiary, your IRA assets may end up in probate or be spread out, referring to state laws, which may not align with your wishes. Getting professional advice or consulting with experienced financial advisors could be invaluable in avoiding costly missteps along the way. So take charge of your financial future and start making smart choices with your IRA now.

Online

Online

Now, this is something we can’t control, but it can still have a huge effect on our mortgage interest rate. Inflation is simply the general increase in prices over time, and when inflation rises, so do rates. When this happens, lenders usually raise their rates to make up for the increased demand for money. However, inflation can go in both directions, so it’s best to talk to your lender and discuss any options they might have.

Now, this is something we can’t control, but it can still have a huge effect on our mortgage interest rate. Inflation is simply the general increase in prices over time, and when inflation rises, so do rates. When this happens, lenders usually raise their rates to make up for the increased demand for money. However, inflation can go in both directions, so it’s best to talk to your lender and discuss any options they might have.

When you co-sign a loan, you are legally liable for making the payments if the primary borrower fails to do so. Your credit score can be negatively affected, and you may even face legal consequences. In fact, you can get sued and have your wages garnished if you fail to make payments on a co-signed loan. Not only could this cause financial strain, but it could also damage your personal relationships.

When you co-sign a loan, you are legally liable for making the payments if the primary borrower fails to do so. Your credit score can be negatively affected, and you may even face legal consequences. In fact, you can get sued and have your wages garnished if you fail to make payments on a co-signed loan. Not only could this cause financial strain, but it could also damage your personal relationships. You may think that the horrors mentioned above are temporary and that you can always get out of a co-signed loan agreement if things go south. However, getting out of a co-signed loan agreement is not easy. It may require legal action or for the primary borrower to refinance the loan in their own name. In either case, it can be a long and challenging process that could damage your personal and financial standing.

You may think that the horrors mentioned above are temporary and that you can always get out of a co-signed loan agreement if things go south. However, getting out of a co-signed loan agreement is not easy. It may require legal action or for the primary borrower to refinance the loan in their own name. In either case, it can be a long and challenging process that could damage your personal and financial standing.

One of the primary reasons why people’s personal loan applications are declined is due to their credit score. Your credit score is a number that ranges from 300 to 850 and is generated by information in your credit report. This number represents your creditworthiness and is used by lenders to determine whether or not you’re a good candidate for a loan. If your credit score is on the lower end, your loan application will likely be declined.

One of the primary reasons why people’s personal loan applications are declined is due to their credit score. Your credit score is a number that ranges from 300 to 850 and is generated by information in your credit report. This number represents your creditworthiness and is used by lenders to determine whether or not you’re a good candidate for a loan. If your credit score is on the lower end, your loan application will likely be declined. Last but not least, if you’ve applied for multiple loans in a short period, it may be seen as a red flag by lenders. It is because it can appear that you’re desperate for

Last but not least, if you’ve applied for multiple loans in a short period, it may be seen as a red flag by lenders. It is because it can appear that you’re desperate for

When you finance a purchase, you may be able to spend more than you would if you were paying in cash. This can lead to a higher average order value, which is good for business. If you are a business owner, you may want to consider offering finance to your customers. There are a few things to keep in mind if you decide to offer to finance. You will need to find a lender who is willing to work with you and you will need to ensure that you can afford the payments on the loan. If you offer financing to get people to spend more money, you may have financial trouble.

When you finance a purchase, you may be able to spend more than you would if you were paying in cash. This can lead to a higher average order value, which is good for business. If you are a business owner, you may want to consider offering finance to your customers. There are a few things to keep in mind if you decide to offer to finance. You will need to find a lender who is willing to work with you and you will need to ensure that you can afford the payments on the loan. If you offer financing to get people to spend more money, you may have financial trouble. The other benefit of financing is that it can help you establish a good credit score. This can be helpful if you ever need to take out a loan for a major purchase, such as a home or car. A good credit score can also help you get lower interest rates on loans, saving you money over time.

The other benefit of financing is that it can help you establish a good credit score. This can be helpful if you ever need to take out a loan for a major purchase, such as a home or car. A good credit score can also help you get lower interest rates on loans, saving you money over time.

One of the primary reasons for the increase in household debt is stagnant wages. Inflation has been rising steadily over the past few years, but wages have not kept pace. It means that households are bringing in less money each year while their living costs are increasing. As a result, they are forced to rely on credit to make ends meet. If wage growth does not keep up with inflation, it will become increasingly difficult for households to pay off their debts. It could lead to more defaults and foreclosures, further hurting the economy.

One of the primary reasons for the increase in household debt is stagnant wages. Inflation has been rising steadily over the past few years, but wages have not kept pace. It means that households are bringing in less money each year while their living costs are increasing. As a result, they are forced to rely on credit to make ends meet. If wage growth does not keep up with inflation, it will become increasingly difficult for households to pay off their debts. It could lead to more defaults and foreclosures, further hurting the economy.

The artificial intelligence industry is expected to experience massive growth in the next few years. It’s estimated that the market for AI will exceed $200 billion by 2022. It is partly due to the increasing demand for AI-powered services and products. Businesses are realizing the potential of AI and are investing more resources into this technology. Before putting your money into this industry, make sure you do your research and invest in a company with a strong track record and promising future. It would help if you also were prepared to make a significant investment. The AI market is still in its early stages, and prices are expected to rise as the industry grows.

The artificial intelligence industry is expected to experience massive growth in the next few years. It’s estimated that the market for AI will exceed $200 billion by 2022. It is partly due to the increasing demand for AI-powered services and products. Businesses are realizing the potential of AI and are investing more resources into this technology. Before putting your money into this industry, make sure you do your research and invest in a company with a strong track record and promising future. It would help if you also were prepared to make a significant investment. The AI market is still in its early stages, and prices are expected to rise as the industry grows. The renewable and alternative energy industry is another one that is experiencing rapid growth. It’s estimated that the market for renewables will reach $620 billion by the end of 2022. This growth is driven by several factors, including the increasing demand for clean energy and the falling cost of solar and wind power. If you’re looking to invest in this industry, you should focus on companies involved in the production or distribution of renewable energy. Be prepared to make a significant investment, as this is still a relatively new industry.

The renewable and alternative energy industry is another one that is experiencing rapid growth. It’s estimated that the market for renewables will reach $620 billion by the end of 2022. This growth is driven by several factors, including the increasing demand for clean energy and the falling cost of solar and wind power. If you’re looking to invest in this industry, you should focus on companies involved in the production or distribution of renewable energy. Be prepared to make a significant investment, as this is still a relatively new industry. The blockchain industry is another one that is experiencing rapid growth. In fact, it’s estimated that the blockchain market will reach $20 billion by 2022. This growth is being driven by several factors, including the increasing demand for blockchain-powered services and products. Businesses are realizing the potential of blockchain and are investing more resources into this technology. Before putting your money into this industry, make sure you do your research and invest in a crypto coin with a strong track record and high yield return.

The blockchain industry is another one that is experiencing rapid growth. In fact, it’s estimated that the blockchain market will reach $20 billion by 2022. This growth is being driven by several factors, including the increasing demand for blockchain-powered services and products. Businesses are realizing the potential of blockchain and are investing more resources into this technology. Before putting your money into this industry, make sure you do your research and invest in a crypto coin with a strong track record and high yield return.

One of the best pieces of advice that you can follow when it comes to your

One of the best pieces of advice that you can follow when it comes to your  If you want to save money, then you need to be willing to cut back on your expenses. Take a close look at your budget and see where you can trim the fat. There is no need to live a lifestyle that is beyond your means. If you can live a more modest lifestyle, you will be able to save a lot of money over time. With the things that have happened, many people are rethinking their spending habits and choosing to live a simpler life.

If you want to save money, then you need to be willing to cut back on your expenses. Take a close look at your budget and see where you can trim the fat. There is no need to live a lifestyle that is beyond your means. If you can live a more modest lifestyle, you will be able to save a lot of money over time. With the things that have happened, many people are rethinking their spending habits and choosing to live a simpler life.

One of the best things you can do for your portfolio is to make sure it’s diversified. It means that you should invest in various types of assets, including stocks, bonds, and commodities. Doing this will reduce your risk if an investment doesn’t perform as well as you expected.

One of the best things you can do for your portfolio is to make sure it’s diversified. It means that you should invest in various types of assets, including stocks, bonds, and commodities. Doing this will reduce your risk if an investment doesn’t perform as well as you expected. As we mentioned earlier, it’s essential to diversify your portfolio by investing in a mix of stocks and bonds. But what’s the best way to go about doing this? Well, there’s no one-size-fits-all answer to that question. It all depends on your circumstances and risk tolerance.

As we mentioned earlier, it’s essential to diversify your portfolio by investing in a mix of stocks and bonds. But what’s the best way to go about doing this? Well, there’s no one-size-fits-all answer to that question. It all depends on your circumstances and risk tolerance.

The short answer is that it’s unclear. There are a lot of factors to consider, including the extent of the damage done by the pandemic, how quickly people can get back on their feet, and what kind of support is available from governments and other organizations. That said, there are some general trends we can expect. For example, there will likely be many people who are out of work or who have to take significant pay cuts.

The short answer is that it’s unclear. There are a lot of factors to consider, including the extent of the damage done by the pandemic, how quickly people can get back on their feet, and what kind of support is available from governments and other organizations. That said, there are some general trends we can expect. For example, there will likely be many people who are out of work or who have to take significant pay cuts. Maintaining a healthy balance between spending and saving is essential during the

Maintaining a healthy balance between spending and saving is essential during the

This wallet was one of the first ones created and it allows people all over the world to send money via email and SMS text message using only their phone number or bitcoin address as an identifier! It also provides several perfect services for an online merchant looking to accept bitcoin payments.

This wallet was one of the first ones created and it allows people all over the world to send money via email and SMS text message using only their phone number or bitcoin address as an identifier! It also provides several perfect services for an online merchant looking to accept bitcoin payments. This is a relatively new wallet that has been gaining in popularity lately. It offers several features, such as the ability to use multiple currencies and quickly move funds between them; the ability to buy bitcoins with a credit card or bank transfer; and a built-in exchange so you can trade your bitcoins for other cryptocurrencies!

This is a relatively new wallet that has been gaining in popularity lately. It offers several features, such as the ability to use multiple currencies and quickly move funds between them; the ability to buy bitcoins with a credit card or bank transfer; and a built-in exchange so you can trade your bitcoins for other cryptocurrencies!

You can apply for a loan any time, regardless of where you are at the moment. All you need to do is log into your account and fill out the form with some basic information about yourself and how much money you want to borrow. After that, wait until the lender approves everything.

You can apply for a loan any time, regardless of where you are at the moment. All you need to do is log into your account and fill out the form with some basic information about yourself and how much money you want to borrow. After that, wait until the lender approves everything.

A traditional 401(k) is a tax-deferred account. This means that you pay no taxes on the money going into it. Still, when you take out your funds at retirement age (59 ½) or earlier in certain situations such as disability or buying a house, you will have to pay federal and state income taxes. You can’t withdraw from your 401(k) when you need the funds because you will be taxed.

A traditional 401(k) is a tax-deferred account. This means that you pay no taxes on the money going into it. Still, when you take out your funds at retirement age (59 ½) or earlier in certain situations such as disability or buying a house, you will have to pay federal and state income taxes. You can’t withdraw from your 401(k) when you need the funds because you will be taxed. Paying taxes sucks, and we all hate the IRS, but you might not hate it as much if you have a 401(k) plan because the amount of tax that is taken from your account will not be very high. With a gold IRA rollover, you don’t have to worry about paying all kinds of taxes on what’s in your new retirement account and getting tied up with complicated paperwork, or having to pay an excessive amount of money because you didn’t file the correct paperwork.

Paying taxes sucks, and we all hate the IRS, but you might not hate it as much if you have a 401(k) plan because the amount of tax that is taken from your account will not be very high. With a gold IRA rollover, you don’t have to worry about paying all kinds of taxes on what’s in your new retirement account and getting tied up with complicated paperwork, or having to pay an excessive amount of money because you didn’t file the correct paperwork.

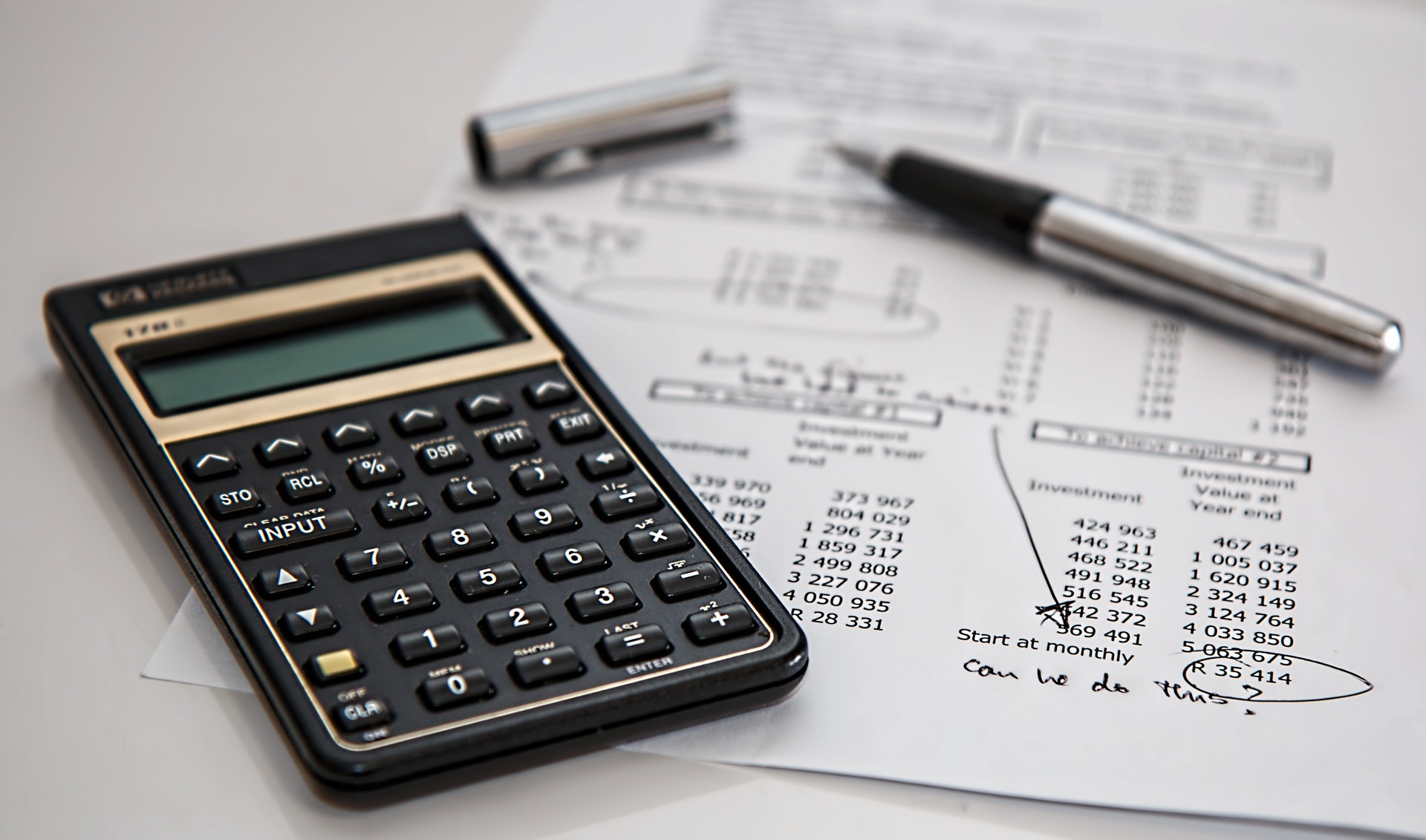

Let’s first define what accounting services are. It

Let’s first define what accounting services are. It  An accounting system helps you identify all unnecessary costs and gives you the ability to reduce them. It is easier to file tax returns correctly and on time if the accounting is done by a professional. You do not need to hire tax professionals to do it. Accounting service providers have the skills and knowledge to provide important information in the most appropriate formats.

An accounting system helps you identify all unnecessary costs and gives you the ability to reduce them. It is easier to file tax returns correctly and on time if the accounting is done by a professional. You do not need to hire tax professionals to do it. Accounting service providers have the skills and knowledge to provide important information in the most appropriate formats.

Separate your personal finances from your business finances to protect your personal finances. You can easily manage your taxes and avoid legal consequences by keeping them separate. This will ensure that your personal finances are protected in the event of a dispute between you and your business. You should open a business checking or savings account that is specific to your business.

Separate your personal finances from your business finances to protect your personal finances. You can easily manage your taxes and avoid legal consequences by keeping them separate. This will ensure that your personal finances are protected in the event of a dispute between you and your business. You should open a business checking or savings account that is specific to your business. You may need financing loans to pay for large expenses as your business grows. Good business credit is necessary to be approved for any transaction, whether it’s buying or renting property. If you have a bad credit score, you may not be approved. Avoid high-interest loans, don’t overcharge your business credit cards, and dispute any discrepancies that appear on your credit report. Personal credit can have a significant impact on business credit.

You may need financing loans to pay for large expenses as your business grows. Good business credit is necessary to be approved for any transaction, whether it’s buying or renting property. If you have a bad credit score, you may not be approved. Avoid high-interest loans, don’t overcharge your business credit cards, and dispute any discrepancies that appear on your credit report. Personal credit can have a significant impact on business credit.

This form of application has a wide variety of features and helps with budgeting, reporting on key metrics, and tracking daily expenses. More advanced applications can help with tax rates or proper financial record keeping. This is what big companies use these days. They have found using the software very helpful. The growing number of business owners have grown increasingly throughout the years.

This form of application has a wide variety of features and helps with budgeting, reporting on key metrics, and tracking daily expenses. More advanced applications can help with tax rates or proper financial record keeping. This is what big companies use these days. They have found using the software very helpful. The growing number of business owners have grown increasingly throughout the years.

It helps not to pay to protect against taking funds away from the administration. It is quite easy to overspend on expensive equipment or bring in a large number of workers who are willing to spend. The most appropriate plan of action is to fully address the growth of the business and make sure it reaches its goals before spending large amounts of money on purchases or staff. This is very important to understand. Many business owners commit this mistake many times.

It helps not to pay to protect against taking funds away from the administration. It is quite easy to overspend on expensive equipment or bring in a large number of workers who are willing to spend. The most appropriate plan of action is to fully address the growth of the business and make sure it reaches its goals before spending large amounts of money on purchases or staff. This is very important to understand. Many business owners commit this mistake many times.

This phrase often plagues small business owners. This form of financing is available without having to provide collateral or security and can appeal to entrepreneurs who have cash flow issues from time to time. A person can simply schedule family and friends if it is not a large amount. However, it may not be the perfect substitute for small business financing. SB owners want money immediately and also without collateral.

This phrase often plagues small business owners. This form of financing is available without having to provide collateral or security and can appeal to entrepreneurs who have cash flow issues from time to time. A person can simply schedule family and friends if it is not a large amount. However, it may not be the perfect substitute for small business financing. SB owners want money immediately and also without collateral.  Startups don’t take into account the size and sustainability of the market they want to work in. The recommendation is to use the MVP or perhaps “Minimum Viable Product” principle, which usually means you have an extremely simple version of your core service or product offering and take it immediately to the target market. The main goal of these activities is to get information and make a purchase when it is mutually beneficial.

Startups don’t take into account the size and sustainability of the market they want to work in. The recommendation is to use the MVP or perhaps “Minimum Viable Product” principle, which usually means you have an extremely simple version of your core service or product offering and take it immediately to the target market. The main goal of these activities is to get information and make a purchase when it is mutually beneficial.

Inflation is the idea that you recover more than the value of cash when prices rise. Even though the average rate of a house is no longer $40,000, as it was in 1975, the amount of gold bullion needed to buy the same property is just as constant: $40,000 worth of gold in 1975 is now worth over $310,000. This means that regardless of what gold is not paying for, its price generally will not follow the rate of increase or inflation.

Inflation is the idea that you recover more than the value of cash when prices rise. Even though the average rate of a house is no longer $40,000, as it was in 1975, the amount of gold bullion needed to buy the same property is just as constant: $40,000 worth of gold in 1975 is now worth over $310,000. This means that regardless of what gold is not paying for, its price generally will not follow the rate of increase or inflation.

The average monthly Social Security benefit is about $1,400. It may not be enough to cover monthly expenses and ensure a retirement. But even more importantly, social security isn’t a sure bet. By 2034, all of the money in the program’s reserves could be depleted, which means the government may want to cut benefits for future retirees by 21%. Social Security helps provide extra income for older and middle-aged Americans.

The average monthly Social Security benefit is about $1,400. It may not be enough to cover monthly expenses and ensure a retirement. But even more importantly, social security isn’t a sure bet. By 2034, all of the money in the program’s reserves could be depleted, which means the government may want to cut benefits for future retirees by 21%. Social Security helps provide extra income for older and middle-aged Americans. No one wants to have a

No one wants to have a